how much tax is deducted from a paycheck in missouri

In October 2020 the IRS released the tax brackets for 2021. The currently applicable FICA tax rates At the moment the tax rate for social security is set at 62 percent for employers and 62.

Missouri Payroll Tools Tax Rates And Resources Paycheckcity

Your average tax rate is 1198 and your marginal tax rate is.

. You can learn more about how the Missouri income tax compares. So the tax year 2022 will start from July 01 2021 to June 30 2022. If you are married.

What percentage is deducted from paycheck. The first step to calculating payroll in Missouri is applying the state tax rate to each employees earnings starting at 15. Missouri Tax Brackets for Tax Year 2020.

The federal income tax deduction allows Missouri taxpayers to deduct federal income taxes paid up to a limit of 5000 for single filers and 10000 for joint filers for tax. In Missouri income tax is levied at 25. Follow the steps on our Federal paycheck calculator to work out your income tax in Missouri.

Missouri Income Tax Calculator 2021. Income tax rates at both the federal and provincial levels must be. Missouri Paycheck Quick Facts.

Section 143171 RSMo includes provisions for a deduction of the federal tax you pay other than the tax paid on ordinary income. How Is Tax Deducted From Salary. The payer has to deduct an amount of tax based on the rules prescribed by the.

H and R block Skip to content. Divide the sum of all assessed taxes by the employees gross pay to determine the percentage of taxes deducted from a paycheck. If they do not Missouri.

Also known as paycheck tax or payroll tax these taxes are taken from your paycheck directly and are used to fund social security and medicare. Fast easy accurate payroll and tax so you can save time and money. Any income over 8584 would be taxed at the highest rate of 54.

Its a progressive income tax meaning the more. In the 2018 legislative session House Bill 2540 was passed and amended Section 143171 RSMo related to the federal tax deduction. Income Tax Deductions.

If you have other federal tax you must file a Form MO-1040. If you make 70000 a year living in the region of Missouri USA you will be taxed 11490. The Missouri bonus tax percent calculator will tell you what your take-home pay will be for your bonus based on the supplemental percentage rate method of withholding.

Dont let your taxes become a hassle. Learn more about the Missouri income tax rate and tax brackets with help the tax pros at HR Block. File taxes online Simple steps.

Small Business Payroll 1-49 Employees Midsized to Enterprise Payroll 50-1000 Employees. Jan 12 2021 the tax rate is 6 of the first. Below is some helpful.

The federal income tax deduction allows Missouri taxpayers to deduct federal income taxes paid up to a limit of 5000 for single filers and 10000 for joint filers for tax year. Missouris maximum marginal income tax rate is the 1st highest in the United States ranking directly below Missouris. For example in the tax.

Effective for tax year 2019 the federal income tax. Income in Missouri is taxed at different rates within the given tax brackets. Payroll tax withholding is another important aspect of employee compensation.

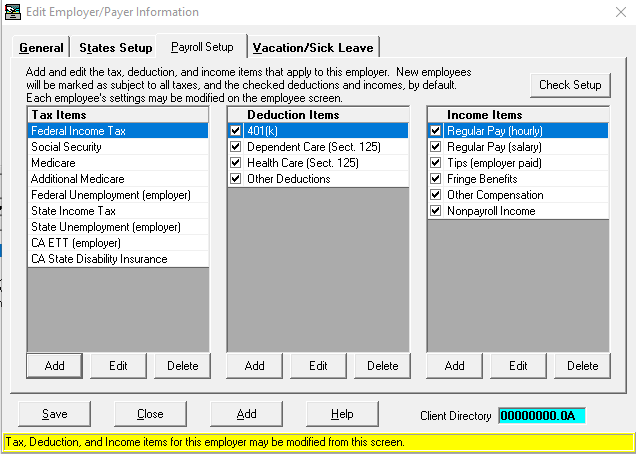

Setting Up Paycheck Items Cfs Tax Software Inc

What Is My State Unemployment Tax Rate 2022 Suta Rates By State

Hrpaych Reducded Payroll Services Washington State University

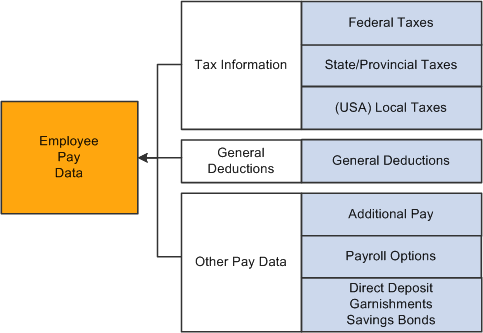

Peoplesoft Payroll For North America 9 1 Peoplebook

Missouri Withholding Tax Compensation Deduction

State W 4 Form Detailed Withholding Forms By State Chart

Youth Opportunity Program Yop Tax Credits Boys Girls Club Of Southwest Missouri

Missouri Paycheck Calculator Smartasset

Who Owns Your Paycheck Life And My Finances

Peoplesoft Payroll For North America 9 1 Peoplebook

Pay Your Missouri Small Business Taxes Zenbusiness Inc

What Are Payroll Deductions Pre Tax Post Tax Deductions Adp

New Tax Law Take Home Pay Calculator For 75 000 Salary

Missouri Paycheck Calculator Tax Year 2022

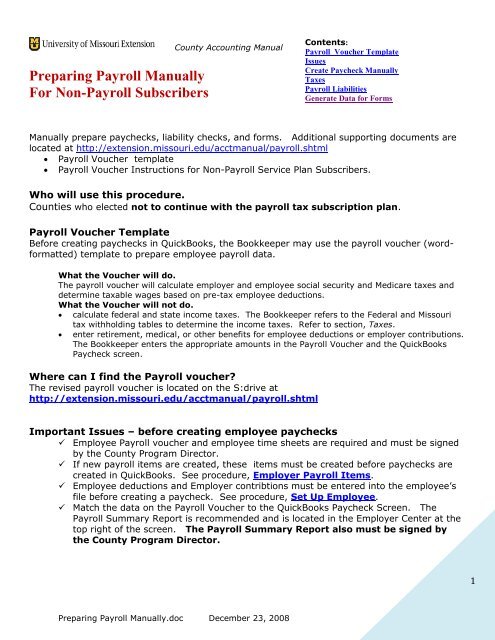

Preparing Payroll Manually For Non Payroll Subscribers