non ad valorem tax florida

The Palm Bay case and FS. Non-ad valorem assessments are assessed to provide certain benefits to your property including services such as landscaping security lighting and trash disposal.

You may also be part of a special district or assessment boundary that has.

. CUSTODIAN OF PUBLIC RECORDS. The ad valorem taxes are based on a calendar year January 1st to December. Should a non-ad valorem.

162 could thus lead to a constitutional challenge against the collection of nuisance abatement costs on tax bills. Florida Statute 200001 provides a more detailed breakdown of the millage rate categories. Non-Ad Valorem assessments are primarily assessments for paving services storm water and solid waste collection and disposal.

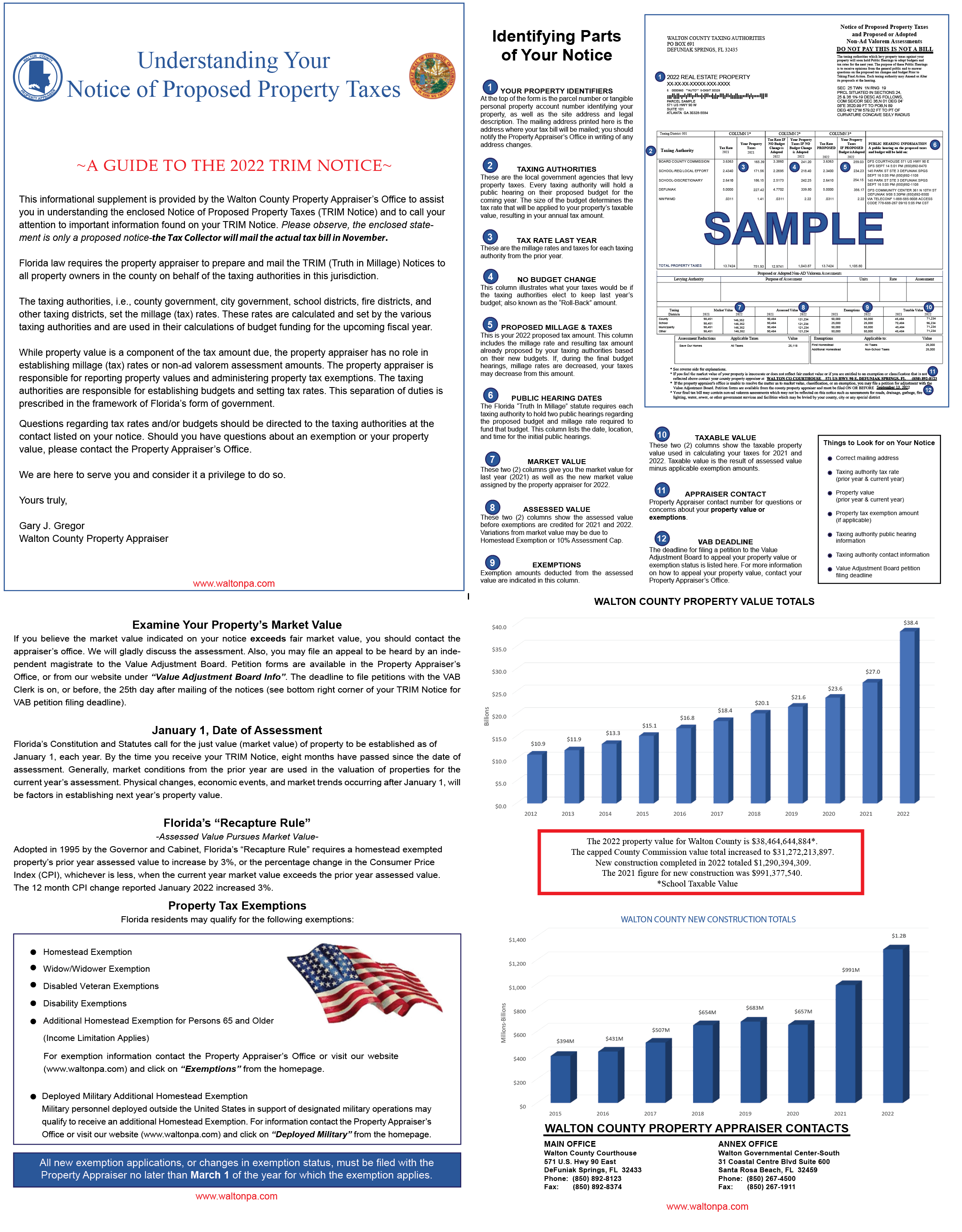

The Non-Ad Valorem office is responsible for preparing a certified Non-Ad Valorem Assessment. Under Florida Statute 197 the Tax Collector has the responsibility for the collection of ad valorem taxes and non-ad valorem taxes. Florida property taxes vary by county.

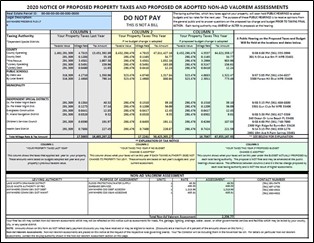

The information contained herein is for ad valorem tax assessment purposes onlyThe Property Appraiser exercises strict auditing procedures to ensure validity of any transaction received and posted by this office but cannot be responsible for errors or omissions in the information received from external sources. Office of the Monroe County Tax Collector 1200 Truman Ave Ste 101 Key West FL 33040 305 295-5000. In Florida the real estate tax bill is a combined notice of ad valorem taxes and non-ad valorem assessments.

The tax year runs from January 1st to December 31st. In Florida the real estate tax bill is a combined notice of ad valorem taxes and non-ad valorem assessments. The office of the Property Appraiser establishes the value of the property and the Board of County Commissioners School Board.

Taxes on all real estate and other non-ad valorem assessments are billed collected and distributed by the Tax Collector. Non-ad valorem assessments are not based on value but a unit of measure. A Levy means the imposition of a non-ad valorem assessment stated in terms of rates against all appropriately located property by a governmental body authorized by law to impose non-ad.

A Non-Ad Valorem Assessment is a legal financing mechanism or method wherein the County establishes a special district to allow a group of citizens to fund a desired improvement such. Ad Valorem TaxesNon-Ad Valorem Taxes. Any assessment for tax purposes that is less than the propertys just value is a classified use assessment.

Ad valorem taxes are paid in. These are levied by the county municipalities. The collection of taxes as well as the assessment is in.

The tangible tax bill is only for ad valorem taxes. The collection of taxes as well as the assessment is in accordance with the rules and regulations of the Florida Department of Revenue and. An ad valorem tax levied by the board for operating purposes exclusive of debt service on bonds shall not exceed 3 mills except that a district authorized by a local general-purpose.

Tax collectors are required by law to annually submit information to the Department of Revenue on non-ad valorem assessments collected on the property tax bill Notice of Taxes. The Property Appraiser establishes the taxable value of real. An appraiser may assess property at lower than just value if it meets the statutory.

In accordance with 2017-21 Laws of Florida. Some counties use only or nearly only valorem taxes.

Property Taxes Lake County Tax Collector

Taxes St Lucie Tax Collector Fl

The Palm Beach County Property Appraiser S August 2021 Newsletter City Of Westlake Florida

Trim Information Walton County Property Appraiser

Property Taxes Brevard County Tax Collector

Real Estate Property Tax Constitutional Tax Collector

Non Ad Valorem Assessments Citrus County Tax Collector

Free Form Dr 462 Application For Refund Of Ad Valorem Taxes Free Legal Forms Laws Com

Understanding Your Tax Bill Seminole County Tax Collector

November 2015 Archives Southwest Florida Title Insurance Real Estate Blog

Tax News And Information Lower Your Property Taxes With Property Tax Professionals

Ppt Non Ad Valorem Assessments Powerpoint Presentation Free Download Id 2927271

Estimating Florida Property Taxes For Canadians Bluehome Property Management

Explaining The Tax Bill For Copb

Florida Voters To Consider Permanent Cap On Annual Non Homestead Property Tax Assessments The Legal Scoop On Southwest Florida Real Estate