pa auto sales tax rate

1795 rows Combined with the state sales tax the highest sales tax rate in Pennsylvania is 8 in the cities of Philadelphia Bensalem Glenside Feasterville Trevose and Lansdowne and seven. When purchasing or selling used vehicles including motorcycles in Pennsylvania many taxpayers are unaware that sales tax due to the Department of Revenue is a percentage of the.

A Complete Guide On Car Sales Tax By State Shift

635 for vehicle 50k or less.

. We offer sedans SUVs pickup trucks hybrids coupes and so much more. 260 per pack of 20 cigaretteslittle cigars. Of course all of our vehicles are fully.

The sales tax rate for Allegheny County is 7. Eight-digit Sales Tax Account ID Number. For instance if your new car costs.

Pennsylvania State Sales Tax. Additionally the state allows local jurisdictions to add additional sales tax. If you trade in a vehicle only the.

The Pennsylvania sales tax rate is currently 6. Select View Sales Rates and Taxes then select city and add percentages for total sales tax rate. Nine-digit Federal Employer Identification.

With local taxes the total sales tax rate is between 6000 and. Effective October 30 2017 a prorated partial day fee for carsharing services was. The following is what you will need to use TeleFile for salesuse tax.

The car sales tax in Pennsylvania is 6 of the purchase price or the current market value of the vehicle according to the PennDOT facts sheet. This is the total of state county and city sales tax rates. The state county or municipalities can also add specialty taxes.

Pennsylvania sales tax is 6 of the purchase price or current market value of the vehicle 7 for Allegheny County and 8 for the City of Philadelphia. Maximum Local Sales Tax. The Pennsylvania state sales tax rate is 6 and the average PA sales tax after local surtaxes is 634.

Maximum Possible Sales Tax. Residents in Allegheny County though pay 7 tax and those in the city Philadelphia pay. The minimum combined 2022 sales tax rate for Scranton Pennsylvania is.

1 percent for Allegheny County 2 percent for Philadelphia. 31 rows Pennsylvania PA Sales Tax Rates by City The state sales tax rate in Pennsylvania is 6000. The date that you.

Groceries clothing prescription drugs and non-prescription drugs are exempt from the. What is the sales tax rate in Scranton Pennsylvania. 775 for vehicle over.

The information you may need to enter into the tax and tag calculators may include. Pennsylvania charges a flat rate of 6 sales tax on most vehicle purchases in the state. The PA Auto Sales showroom is chock full of quality used cars for sale.

Pennsylvania collects a 6 state sales tax rate on the purchase of all vehicles with the exception of Allegheny County and the City of Philadelphia. PA Sales Use and Hotel Occupancy Tax. The motor vehicle sales tax rate is 6 percent the same as on other items subject to sales tax plus an additional 1 percent local sales tax for vehicles registered in Allegheny.

The VRT is separate from and in addition to any applicable state or local Sales Tax or the 2 daily PTA fee. Average Local State Sales Tax. This is the total of state county and city sales tax rates.

The vehicle identification number VIN. The make model and year of your vehicle. Pennsylvanias sales and use tax rate is 6 percent.

The minimum combined 2022 sales tax rate for Easton Pennsylvania is 6.

Sales Taxes In The United States Wikipedia

What Are The Vehicle Registration Taxes Fees In Pennsylvania Tri County Toyota

Form Rev 227 Fillable Pa Sales And Use Tax Credit Chart Rev 227

Which U S States Charge Property Taxes For Cars Mansion Global

Form Rev 227 Fillable Pa Sales And Use Tax Credit Chart Rev 227

Used Cars In Pennsylvania For Sale Enterprise Car Sales

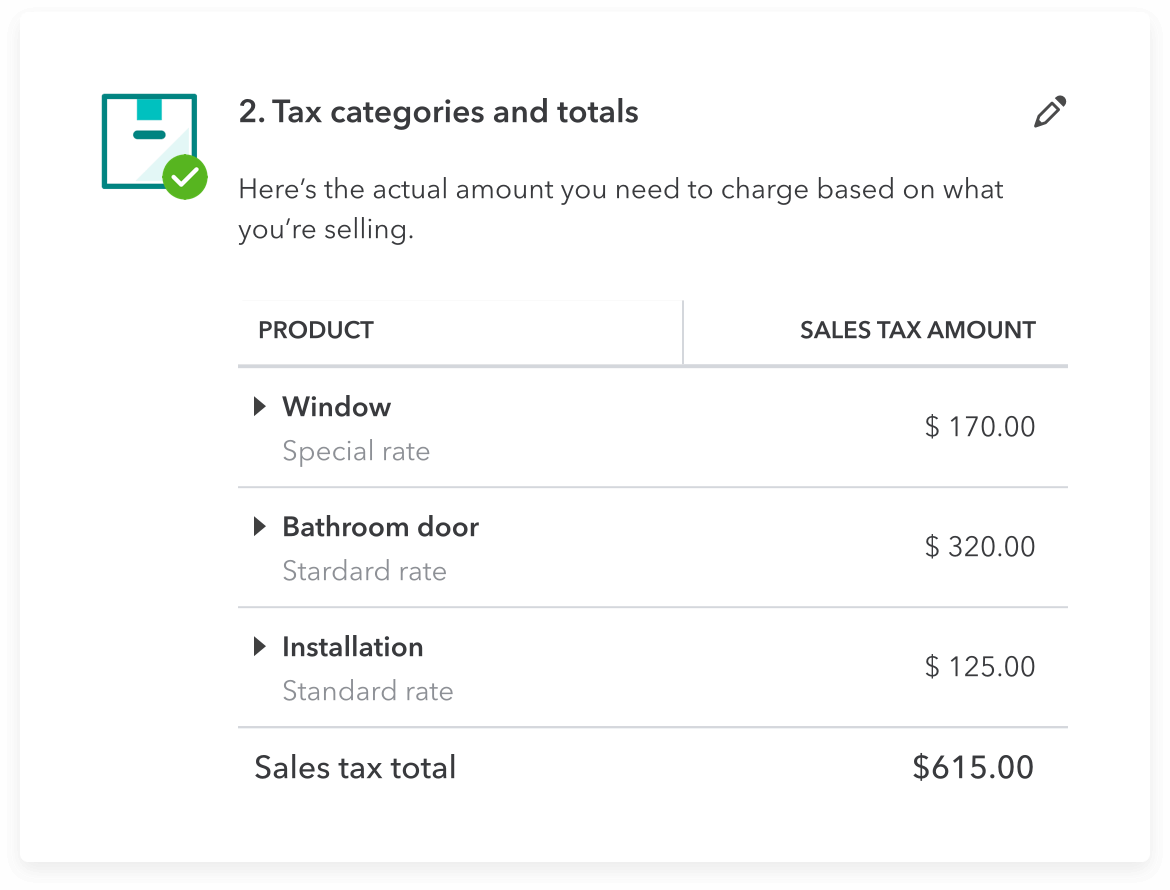

Sales Tax Software For Small Business Quickbooks

What Are The Vehicle Registration Taxes Fees In Pennsylvania Tri County Toyota

Pennsylvania Tax Rate H R Block

Sales Taxes In The United States Wikipedia

Everything You Don T Pay Sales Tax On In Pennsylvania From Books To Utilities On Top Of Philly News

Understanding California S Sales Tax

Car Sales Tax In New York And Calculator Getjerry Com

Gov Beshear Pitches Sales Tax Decrease To Fight Inflation In Kentucky